Now more than ever it’s important for C-suite leadership to understand the buying cycle and how long it takes a qualified inquiry to make it through the sales journey.

Click Here to Download the PDFDeciding to save money in the short run on advertising and inquiry development could have a long-lasting effect. And on the flip side, mounting an immediate and massive nurturing / rejuvenation campaign could yield immense rewards.

Let’s take a look at three colleges and attempt to understand their buyer journey, sales staffing and attitude toward inquiries. All of the charts below reflect enrollments during the first quarter of 2020.

College A

This particular college has a robust contact center. They embrace drip marketing and actively nurture their inquiry database. Their population is over 90% male and they use no traditional marketing. Students find this school from the internet both organically and from paid search on Google Ads and Facebook/Instagram. A small portion of their enrollment comes from face to face interactions at career fairs.

Interestingly enough, 45% of the students who started school in 2020 inquired at least 61 days in advance. And 12% of this year’s population inquired more than 4 months ago.

Take-aways: While most institutions would be focusing on the “new inquiries” from the last two months, this school employs multiple touches and continues to connect with and engage inquiries for many months. This takes appropriate staffing levels and a long-term view. But it also results in many more enrollments.

Final thought: A large scale reduction in advertising (like pausing a month) now could be offset slightly from the “lead bank” – but enrollments will lag dramatically over the next 90 days and in fact it will take at least 4 months to regain momentum.

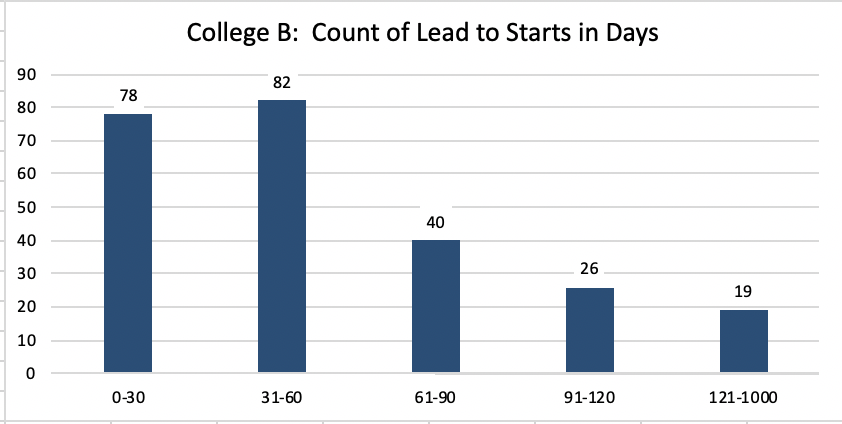

College B

Not unlike College A, this school has a significant portion (35%) of its enrollment coming from inquiries that are more than two months old. However, the absence of a contact center means admissions advisors are tasked with the responsibility for contacting all inquiries – both new, old and VERY old.

This institution is also committed to on-going contact with its inquiry database in the form of email and text messages. Inquiry sources include digital efforts similar to College A — but in addition to digital, College B spends about one third of its budget on traditional channels.

Takeaways: Adding a contact center and actively recycling older inquires could yield substantial success for College B. The “direct response” nature of the traditional inquiries results in a larger number of students who are further down the buying path and who are ready to enroll sooner, but more support could be given to working older inquiries.

Final Thoughts: A large scale reduction in advertising (like pausing a month) now would create disaster for the following two months as enrollments could fall off by 60% in the two months immediately after “going dark.” The absence of a contact center will also translate to fewer enrollments from older inquires and would exacerbate the situation. All told, it will be very challenging to ever regain the ground lost after pausing or greatly reducing lead generation.

College C

This could be a conundrum. How do you manage an extended enrollment funnel when almost 60% of your starts this year have been in your data base for three months to three years? SMH.

The good news: The combined efforts of admissions and marketing are effectively nurturing the database. Deeper insight would reveal this college attracts some high school seniors – but not at significant numbers. However, the behavior of the 29 enrollments (23% of the 2020 YTD starts) who inquired more than six months ago merits additional study. If these are in fact 2019 or 2018 HS grads, a targeted effort to message to this population should be tops on the list.

Takeaways: The gaping hole in the production of enrolls from four to six months needs to be addressed. There may be significant gains to be made by addressing this “dormant but not dead” population. Additional inspection internally may also improve cash flow. Could additional start dates be added to accelerate enrollments? Note: Of the three schools studied, College C has less frequent starts.

Final Thoughts: Pulling back on advertising in the short run is probably least disruptive for this school in the immediate near future, as only 20% of enrollments inquire in the prior month. However, when you roll forward over the next two months and consider the cumulative impact, a large advertising cut in month one could actually reduce enrollment by 60% in month two through four. And that’s downright frightening.

Conclusions: Increased awareness of your new student life cycle can yield opportunities you may be missing. Redacting data and sharing with your peers in non-competitive markets would be an excellent way to spend 30 minutes over a cup of coffee. Finally, cutting ad spend now will hurt more later than you realize.

Source: https://www.linkedin.com/pulse/understanding-sales-cycle-vince-norton/

Comments are closed.

Recent Comments